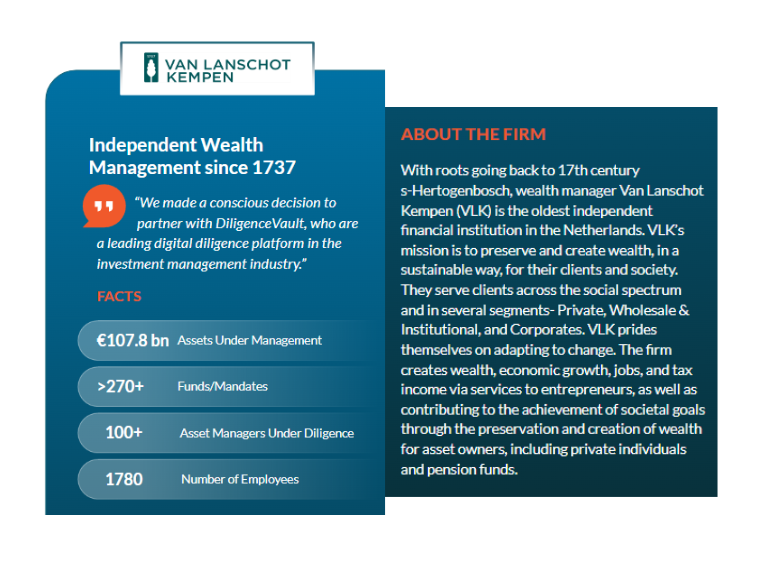

Van Lanschot Kempen (VLK) is a leading independent wealth manager in the Netherlands with a mission to preserve and create wealth, in a sustainable way, for their clients and society. They manage over Euro 100bn in client assets.

Their Manager Research Solutions team services a diverse range of clients which include pension funds, family offices and private banking clients and is recognized for its high-quality due diligence on investment funds across traditional and alternative asset classes. For this team and the firm overall, the need for a digital diligence technology solution was defined based on key criteria:

- Scalability became more difficult as the universe of managers grew

- Communication with managers was individual driven and inefficient

- Regulatory requirements increased and so did the need for reporting, documentation, and monitoring

- The need for a solution to source and process non-standardized information and data increased as investments in the private market grew

To address these challenges, the firm saw DiligenceVault (DV) as an opportunity to develop more efficient processes and reduce key person risk. “We made a conscious decision to partner with DiligenceVault, who are a leading digital diligence platform in the investment management industry.”

Download the case study to see why VLK adopted DiligenceVault and what are the key data collection, analytics and reporting benefits that the firm has derived from this partnership.