The private equity landscape is rapidly evolving, presenting both General Partners (GPs) and Limited Partners (LPs) with a range of new liquidity options, each with unique implications for risk, returns, and portfolio management. From GP stakes and secondaries to NAV lending, evergreen funds, and interval funds, these alternatives demand a thorough understanding and careful due diligence to mitigate potential risks.

Liquidity Options and Market Context

As the market faces fewer exit opportunities and tighter liquidity, GPs and LPs are exploring innovative financial instruments to adapt. Notably, liquidity options such as NAV lending, secondaries, and GP stakes are gaining prominence. This trend is driven by a 50% drop in exit values since Q4 2023, highlighting the need for alternative liquidity solutions. In response, investors are increasingly turning to these instruments to maintain capital flow and manage portfolio risks.

Key Liquidity Alternatives

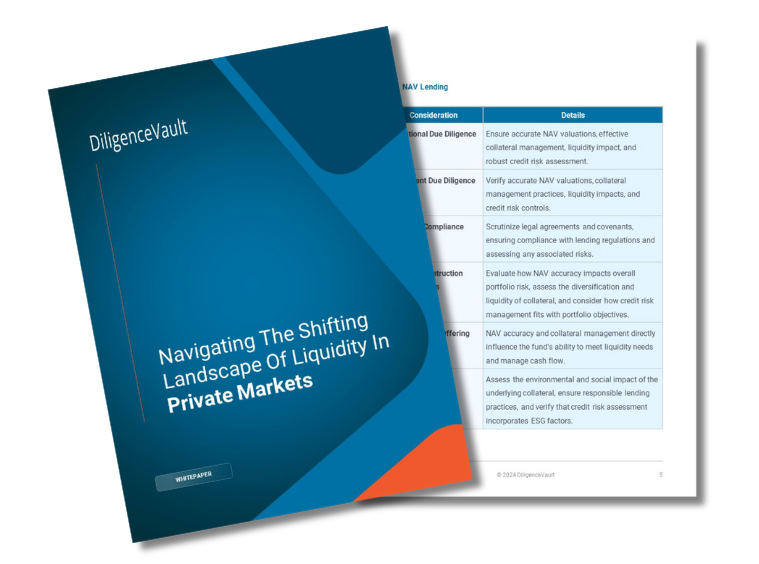

- NAV Lending

- GP-Led Secondaries

- LP-Led Secondaries

- GP Stakes Investing

- Evergreen and Interval Funds

ESG and Compliance Considerations

As ESG factors become increasingly important across private equity, liquidity options such as NAV lending, secondaries, and GP stakes are incorporating responsible investment practices. GPs and LPs must now evaluate these factors as part of their due diligence processes, ensuring that their investments align with broader ESG goals and regulatory expectations.

Importance of Comprehensive Due Diligence

Given the complexity of these liquidity alternatives, thorough due diligence is essential for LPs to make informed decisions. This includes assessing operational stability, investment quality, legal risks, and ESG compliance. DiligenceVault plays a crucial role in enabling LPs to navigate these options by providing tools that facilitate effective risk management and support comprehensive investment strategies.

Download our white paper to explore these liquidity alternatives in greater detail and understand how GPs and LPs can optimize their portfolios in today’s evolving private equity market.