Investment consultants and advisory firms are trusted by their asset owner clients to bring conflict-free investment advice, help select new investment managers, conduct ongoing manager research, support growth and innovation in the industry – by building a pipeline of new and emerging managers.

This is a significant mandate for advisory and investment consulting firms further complicated by the fact that they interact with asset managers globally. There is no comprehensive database of manager information across asset classes, and different investors may have different goals and fiduciary requirements. To succeed, investment consulting firms require a combination of scalable processes, team expertise, and data and technology focus.

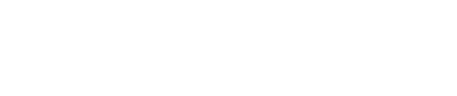

Here’s a case study of our client Meketa Investment Group – an independent, full service investment consulting and advisory firm who integrated technology in their investment and research processes. Since 1978, the Meketa Investment Group has provided creative investment solutions custom tailored to fit the unique circumstances of their clients. Meketa’s services include Traditional Investment Consulting, Private Markets Investment Consulting, and Outsourced CIO services.

Across their discretionary OCIO, investment advisory offering, management of investment RFPs for client mandates, manager sourcing and ongoing diligence are key focus areas. In addition, they maintain a robust Minority / Women / Disabled-owned Business Enterprise (MWDBE) program to empower diverse and emerging managers. To align with their continued growth, Meketa was looking to improve their RFP search processes and digitalize their MWDBE manager sourcing. Historically, Meketa would post RFPs on their website, and asset managers would complete in Word/Excel, and return to Meketa with supporting documentation via email.

To address these challenges, in 2023, Meketa adopted DiligenceVault’s Opportunity Vault module, a solution designed to automate inbound management processes, digitize new searches and RFPs, and scale MWDBE and DEI programs. With Opportunity Vault, Meketa can now track inbound submissions in real-time, gaining valuable insights into asset manager interest.

Download the case study below to learn the details of this partnership – why Meketa chose DiligenceVault, how DV’s module helped transform their process, and what are the key benefits that the firm has derived from this partnership.