Institutional AI. Integrated Decisions.

Institutional AI embedded across the diligence lifecycle.

DiligenceVault delivers AI purpose-built for asset managers and allocators who operate in high-stakes, highly governed environments in the form of DV Assist. Our AI is not a standalone tool or chatbot. It is embedded directly into diligence workflows, ensuring speed, consistency, and trust at scale.

Built for institutions that can’t afford black-box answers.

DV Assist for Asset Managers

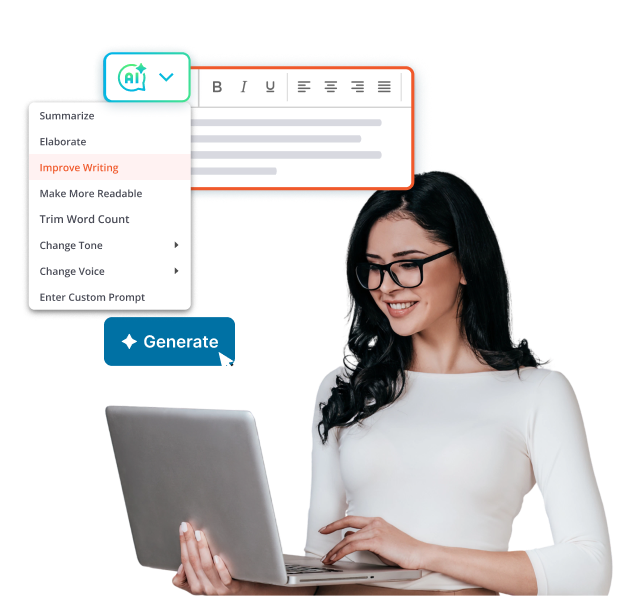

DV Assist helps asset managers meet growing DDQ / RFP volume and investor reporting needs without increasing operational burden.

Key use cases

-

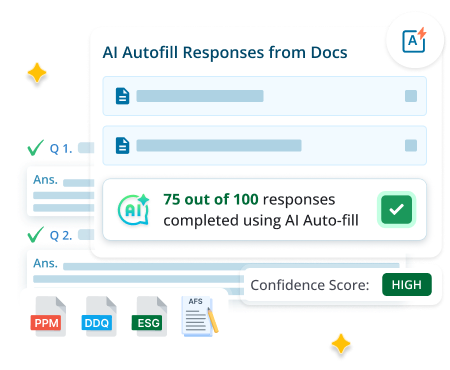

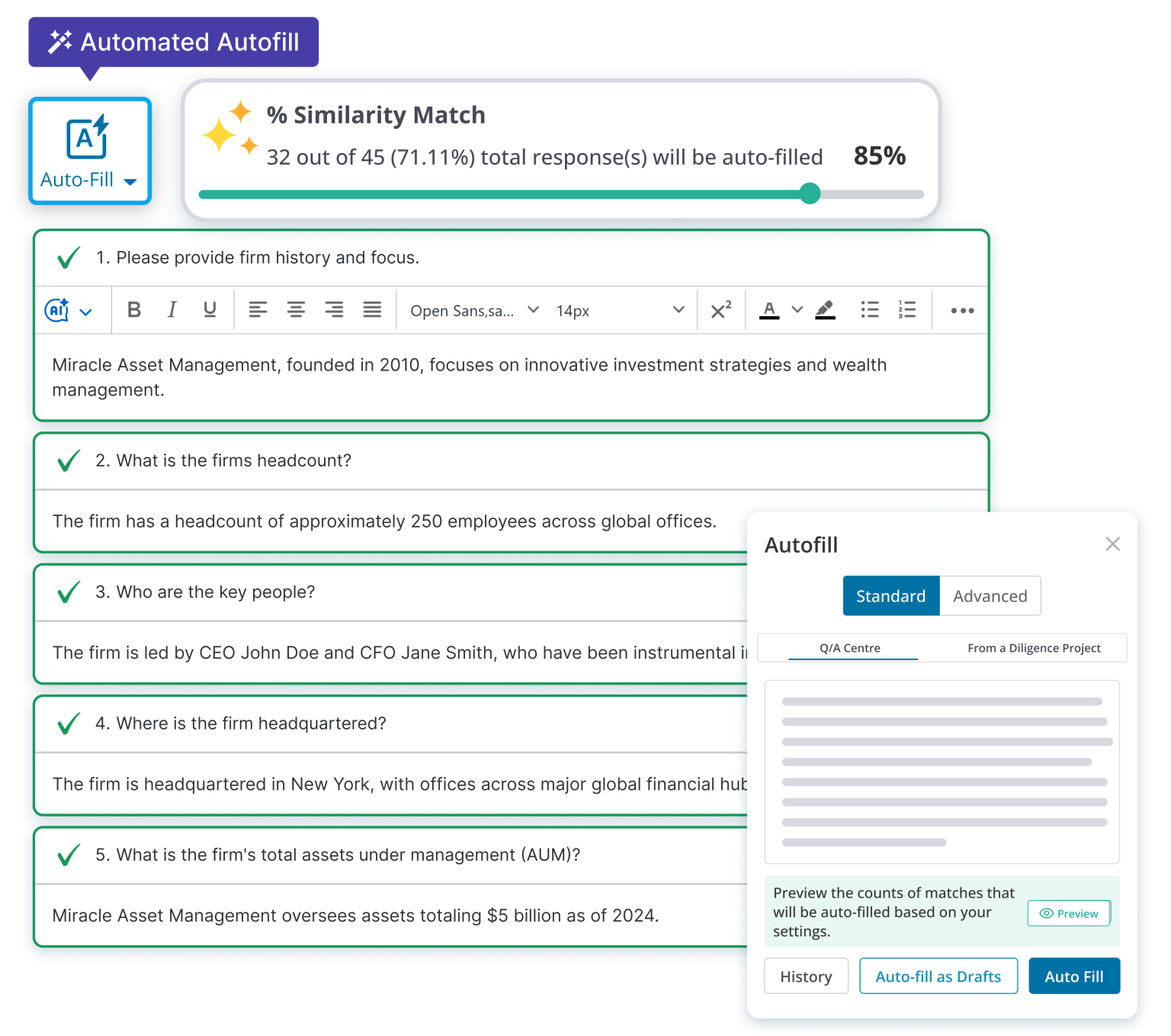

DDQ & RFP Autofill

Accelerate responses using approved historical content and documents -

Investor Communications & Letters

Draft polished, consistent investor communications grounded in firm-approved disclosures. -

Compliance Review of Marketing Materials

Identify inconsistencies, outdated language, and potential risk before materials go out the door.

Respond Faster. Stay Consistent. Reduce Risk.

DV Assist For Allocators

Allocators face growing volumes of complex, unstructured fund documentation. DV Assist transforms this information into structured, decision-ready intelligence.

- AI Document Extraction

Extract structured data from PPMs, LPAs, SAIs, offering documents, side letters, IMAs, ESG policies, sustainability reports, compliance manuals, and audit reports. - Institutional Memo Generation

Generate one-page executive summaries or full 30–50 page investment memos grounded in extracted data, with collaborative review workflows. - Risk Flagging & Exception Identification

Surface inconsistencies, missing disclosures, and risk indicators for focused analyst review. - Benchmarking & Comparison

Normalize and compare data across managers, strategies, and time periods.

Extract. Synthesize. Flag Risk. Decide with Confidence.

Customer Spotlight: AFS Review 70% Faster

A foundation client used DV Assist to support the review of audited financial statements (AFS) across its investment portfolio. They were able to:

Extract key metadata and financial disclosures and analyze auditor concentration

Analyze total expense ratios (TER) and outliers

Flag potential risks embedded in financial statement notes

Build time-series views across reporting periods

All findings were reviewed by the finance and operations teams ensuring defensible, institutional-quality analysis.

AI, Integrated by Design

DV Assist is embedded directly into the platform, not layered on top of it.

What this means in practice

Human-in-the-loop by default

Every AI-assisted output is reviewable, editable, and approved by your team.Explainable and audit-ready

Source citations, version history, and approval trails are native.Built for governance

Your data remains isolated, secure, and under your control.

Faster workflows: without compromising trust, oversight, or accountability.

Learn More About DV Assist - AI Capabilities

A secure and purpose-built AI architecture for both due diligence parties, your AI-powered dream machine for seamless diligence.

DiligenceVault’s Gen AI Resources

Frequently Asked Questions

How is DiligenceVault GenAI different from ChatGPT or Microsoft Copilot?

DiligenceVault GenAI is purpose-built for investment and due diligence workflows, not general conversation or productivity tasks. Unlike standalone AI tools, it is integrated with user workflows, with proprietary AI architecture to deliver high quality auditable output.

How does DiligenceVault prevent hallucinations?

DV Assist uses proprietary AI architecture to ensure outputs are based only on approved source documents rather than open-ended prompting. Insights are traceable to underlying data, uncertainty is flagged instead of guessed, and users can review and validate outputs before they are used, making accuracy and transparency core to the system.

What are DiligenceVault’s AI principles?

DiligenceVault’s AI is guided by:

- principles of human-in-the-loop decision-making,

- quality and transparency,

- security-first design, and

- purpose-built application.

The goal is to augment professional judgment, provide explainable insights, and deliver AI that aligns with the expectations of regulated investment environments.

How does pricing work for DV Assist?

DV Assist pricing is outcome based credit-based and designed to be predictable and scalable. AI capabilities are integrated directly into DiligenceVault workflows, with clear transparency into how credits are consumed and upfront estimates provided for common use cases. This allows teams to plan usage confidently and scale adoption in line with their ROI.

How is my data protected when using DV Assist?

DiligenceVault leverages closed-form solutions and segregates client data while applying AI capabilities to ensure the security of user data.

Is there a way to try DV Assist before committing?

Yes. DiligenceVault offers a free DV Assist trial that allows teams to experience AI capabilities directly within their real workflows. The trial is designed to be seamless, with no complex setup, and provides clear visibility into value delivered—helping teams validate impact, build internal alignment, and create a strong business case before rolling out AI more broadly.