Opportunity Vault

Pitch to Investors

Create and deliver compelling pitches directly through DV. Exceed expectations from the first interaction.

- Use DV AI Autofill and AI Writer to generate first drafts aligned to strategy, performance, and investor needs.

- Win mandates and accelerate investor engagement with intelligence and precision

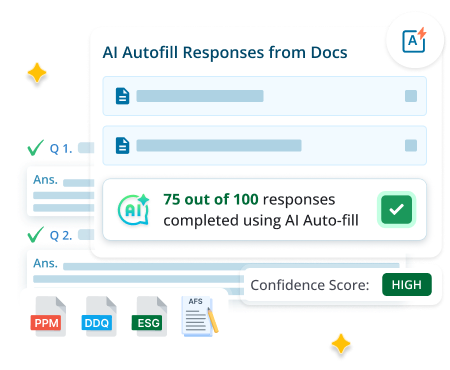

RFP and DDQ Automation

Build Institutional DDQs

Standardize and manage all due diligence materials in one place. Exceed accuracy and consistency with AI.

- Leverage industry frameworks including AIMA, ILPA, INREV, PRI and more.

- Automate updates across cycles with intelligent content reuse and real collaboration.

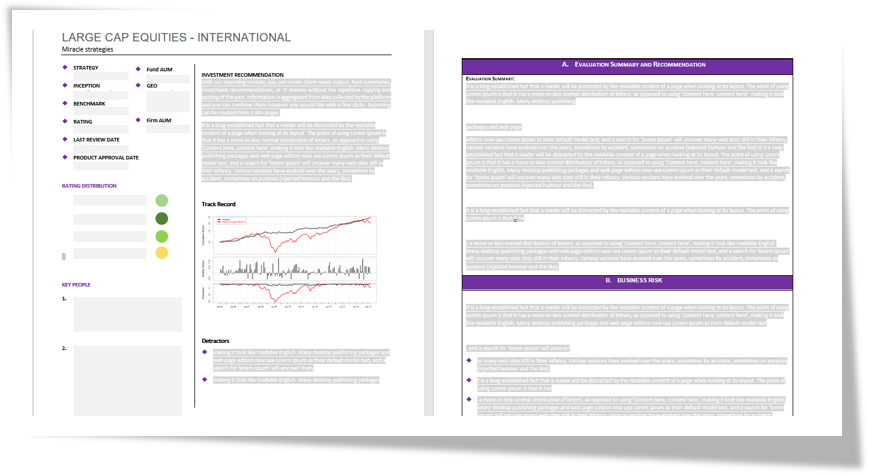

Investor Studio

Deliver Investor Letters

Create investor letters and reporting with ease. Exceed speed and communication quality.

- Produce updates, quarterly letters, and performance commentary in minutes.

- Use DV AI writing tools to refine tone, clarity, and narrative.

- Collaborate securely across IR, distribution, and investment teams.

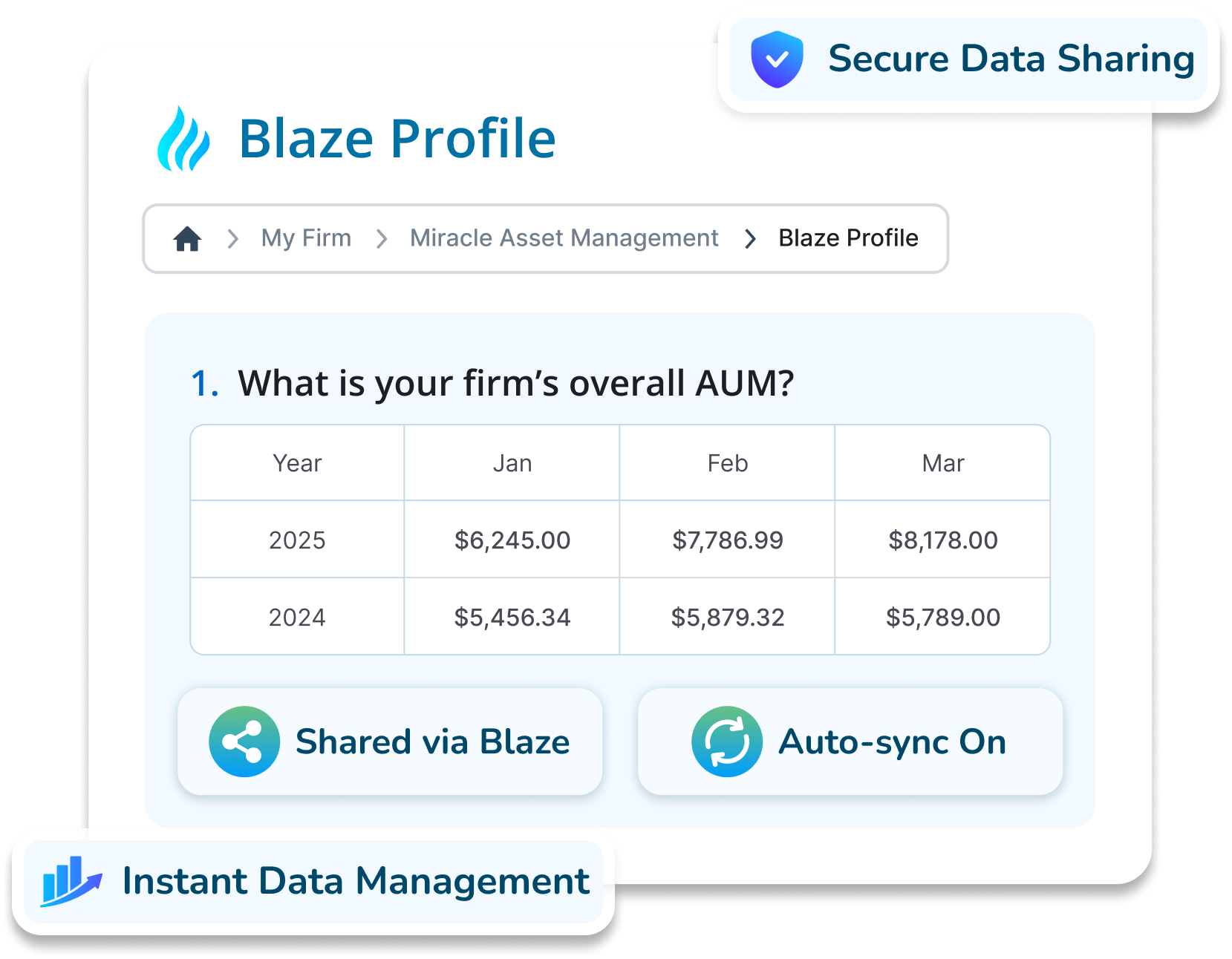

Blaze Data Bridge

Publish Live Profiles

Deliver standard datasets to all investors on DiligenceVault. Exceed investor expectations!

- Update once, distribute to all

- Maintain transparency for institutional and wealth investors

- Give the power of AI to your investors and elevate their experience

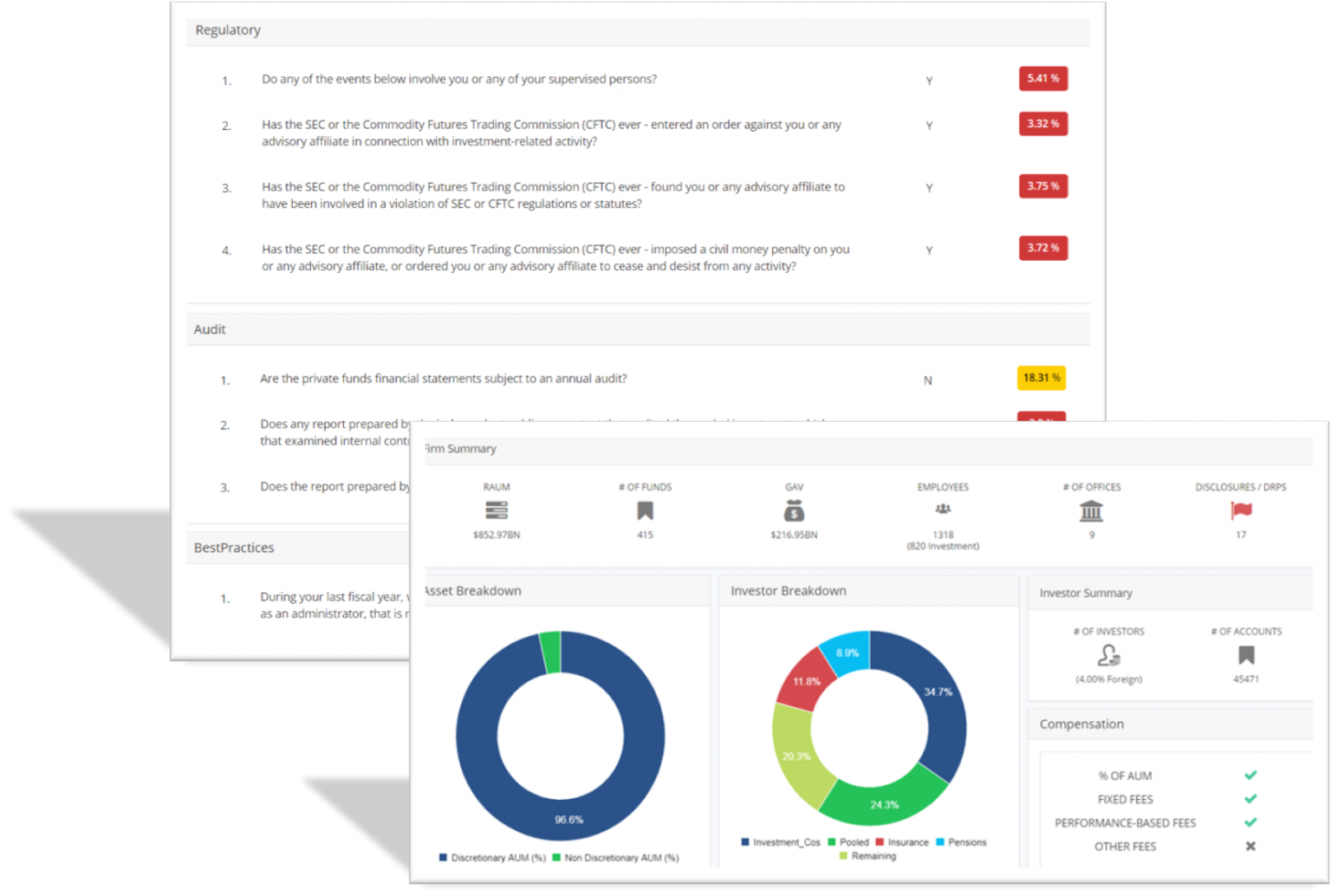

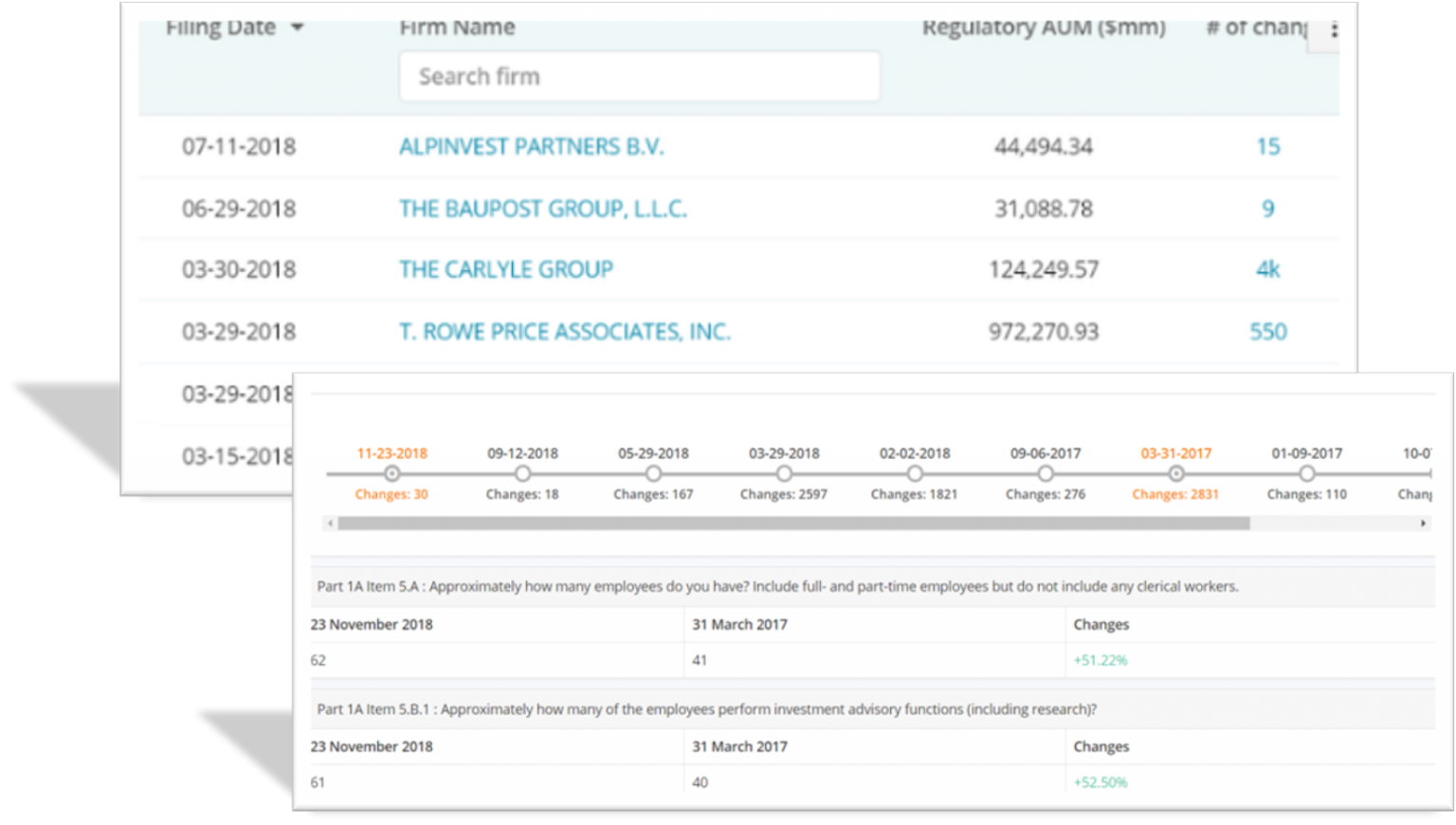

Powerful Analytics

Analytics at your Fingertips

Track investor reporting workflows and data via integrated dashboards.

- Track completion rates, investor engagement, team collaboration KPIs.

- Track investor terms powered by DV Assist Extractor

- Deliver decisions that matter

Related Resources

Discover how asset managers use AI to streamline RFP and DDQ processes, reduce compliance burdens, and build scalable, more efficient workflows.

Read case study to learn how a private debt asset manager used DiligenceVault to centralize data, streamline credit underwriting, and enhance scalability. See how automation reduced inefficiencies and improved compliance.