Digital Diligence

Digitize Your Manager Research

Digital Diligence is a core module that enables you to transform your diligence framework across inbound management, manager research, and portfolio monitoring.

- Build a repository of usable, structured research data and documents by collecting data directly from your external managers

- Avoid avoidable and costly errors when conducting manager research, and eliminate errors that come from manual processes

- Automatically flag risk areas, outliers, and even compliance issues

- Enable transparency for the entire team on a centralized platform. Create a consistent framework for multi-asset portfolios across traditional, hedge, and private market investments

Presentation Layer

Automate Reporting Needs

Presentation is an advanced module that enables you to automate the generation of Investment Committee memos, factsheets, and opinion reports.

- Eliminate the need for copy and paste from multiple data sources

- Overlay collaborative review process in generating opinions and recommendations

- Create presentations from all your research data in a few clicks in your brand

- Enable transparency for the entire team on a centralized platform

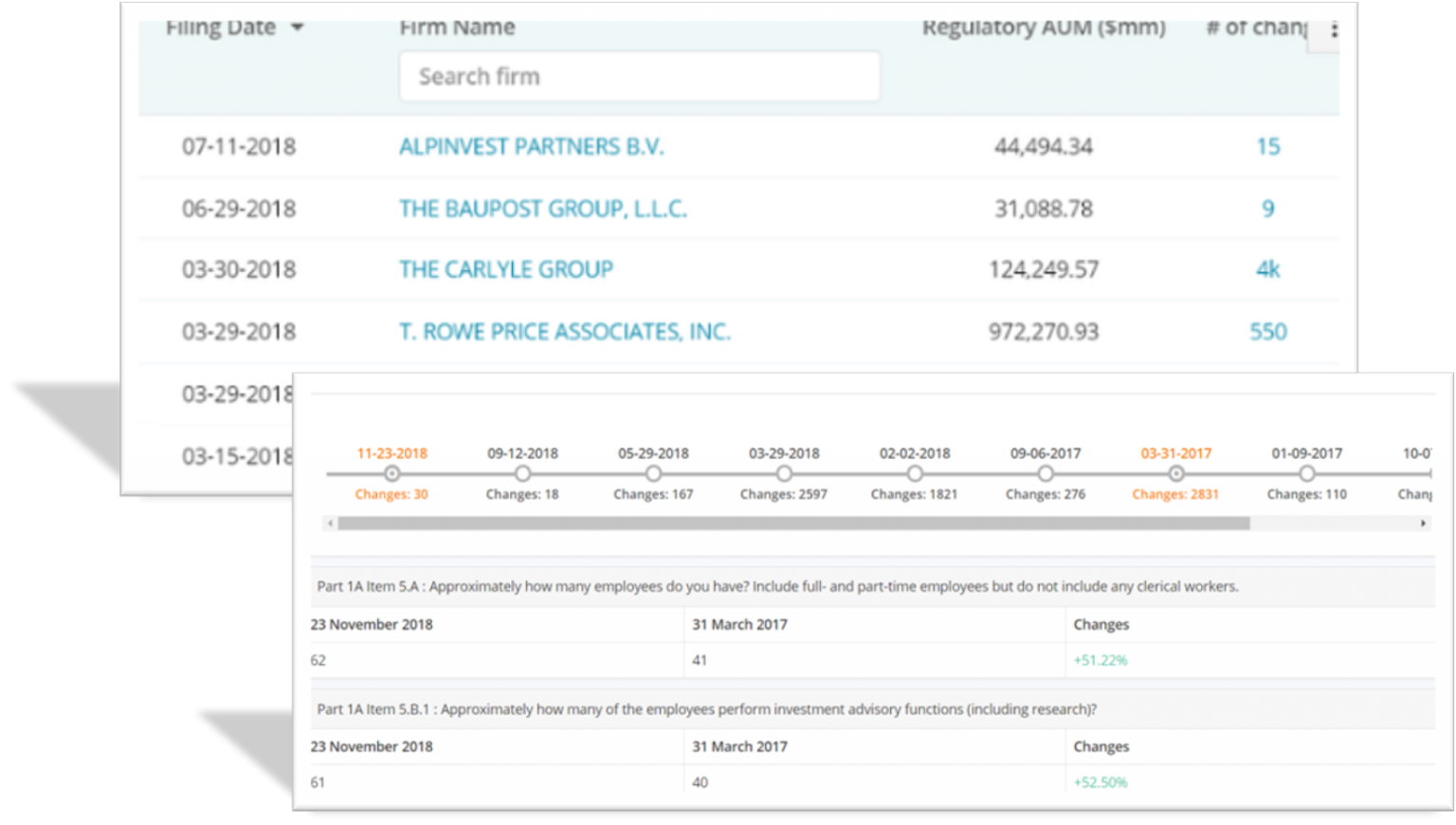

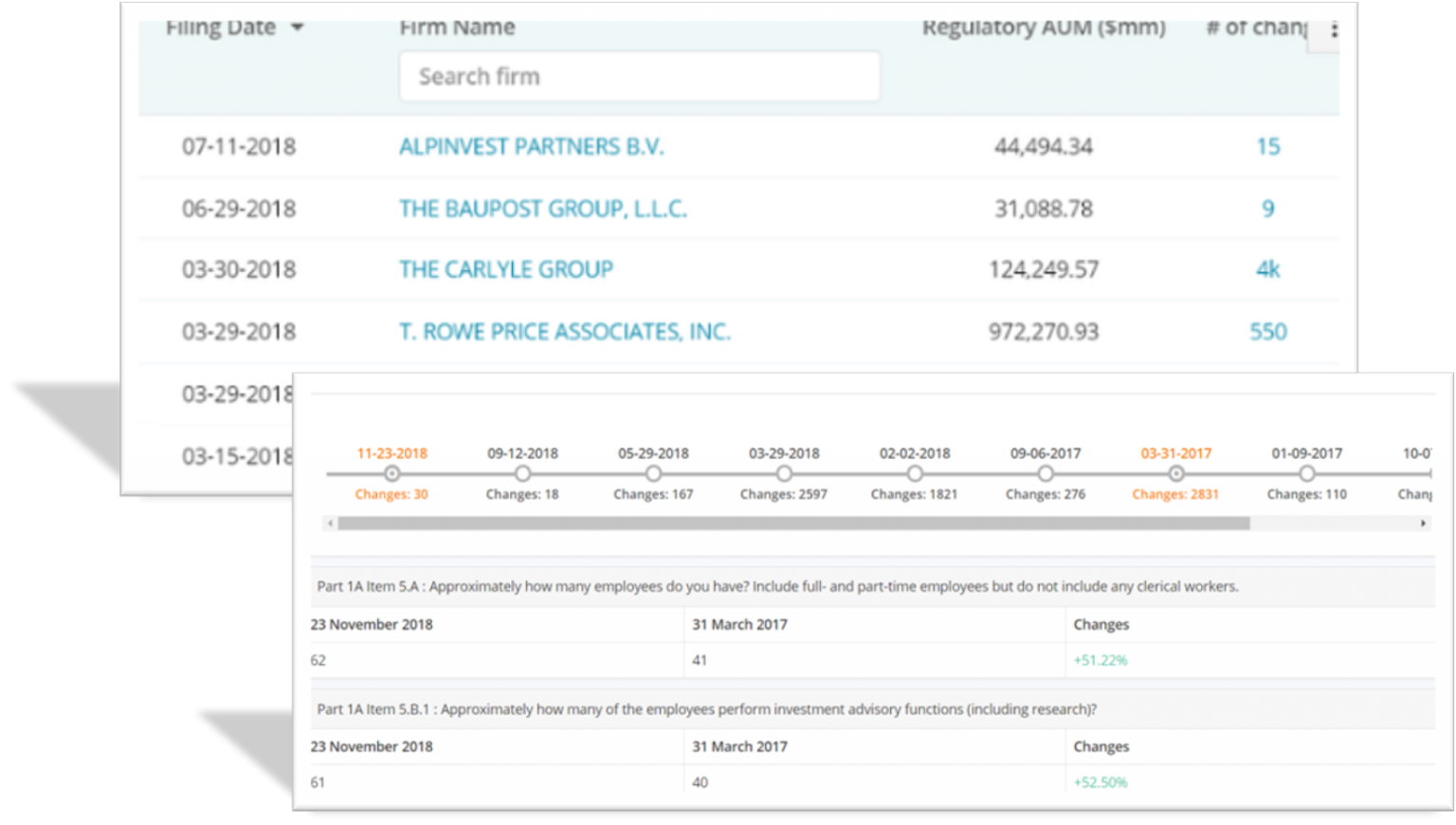

Data Hub

Integrate Regulatory Data Source

FormADV is a regulatory data module that helps in identifying new investment prospects as well as reviewing inbound manager’s profiles. Get answers to questions such as:

- How many PE managers haven’t launched a fund in the past 3 years?

- All hedge fund strategies with certain business characteristics – managed account preference, investor concentration, regulatory profiles

- New launches in the past 30 days

- View Regulatory Data Module

Presentation Layer

Automate Reporting Needs

Presentation is an advanced module that enables you to automate the generation of Investment Committee memos, factsheets, and opinion reports.

- Eliminate the need for copy and paste from multiple data sources

- Overlay collaborative review process in generating opinions and recommendations

- Create presentations from all your research data in a few clicks in your brand

- Enable transparency for the entire team on a centralized platform

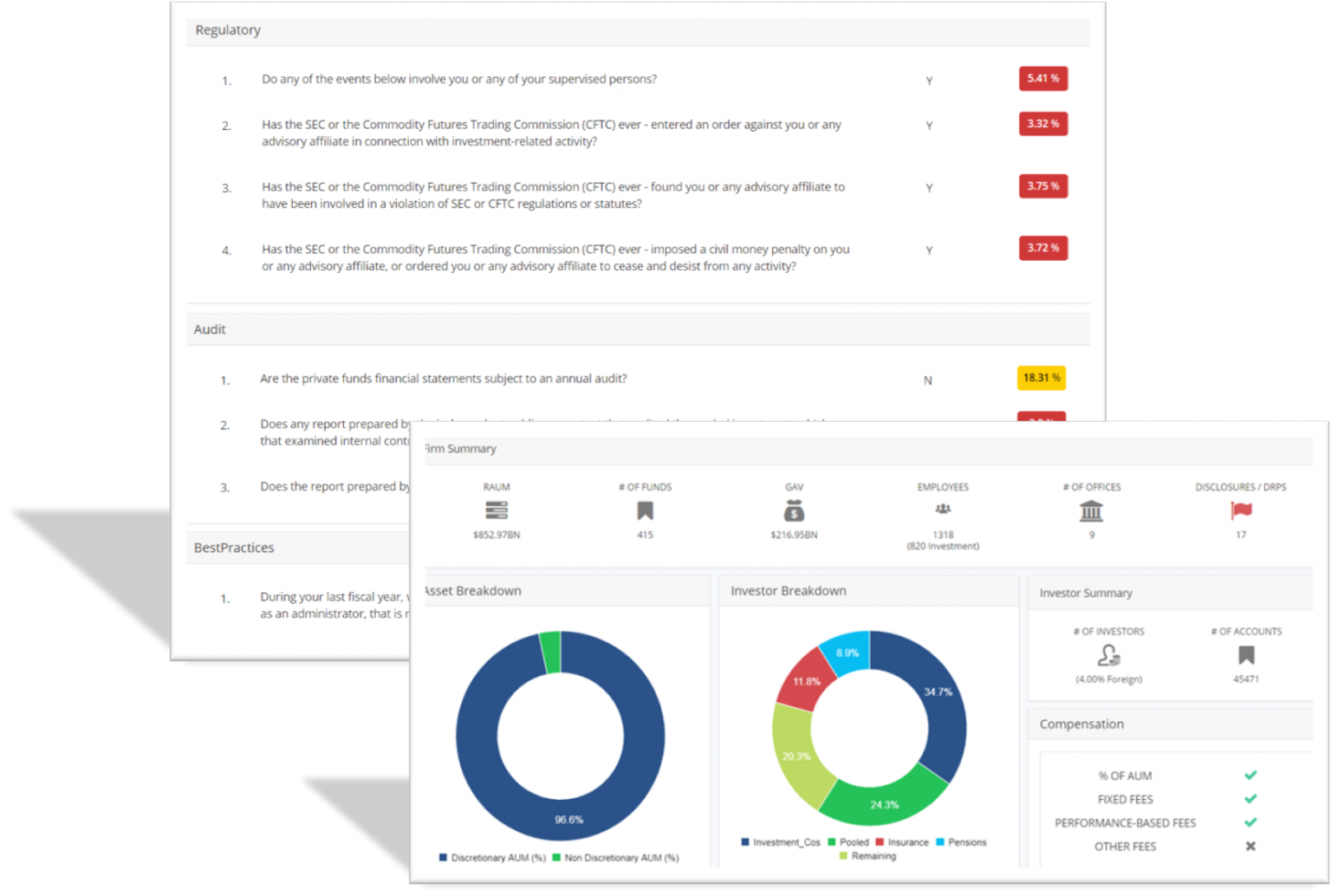

Digital Diligence

Digitize Your Manager Research

Digital Diligence is a core module that enables you to transform your diligence framework across inbound management, manager research, and portfolio monitoring.

- Build a repository of usable, structured research data and documents by collecting data directly from your external managers

- Avoid avoidable and costly errors when conducting manager research, and eliminate errors that come from manual processes

- Automatically flag risk areas, outliers, and even compliance issues

- Enable transparency for the entire team on a centralized platform. Create a consistent framework for multi-asset portfolios across traditional, hedge, and private market investments