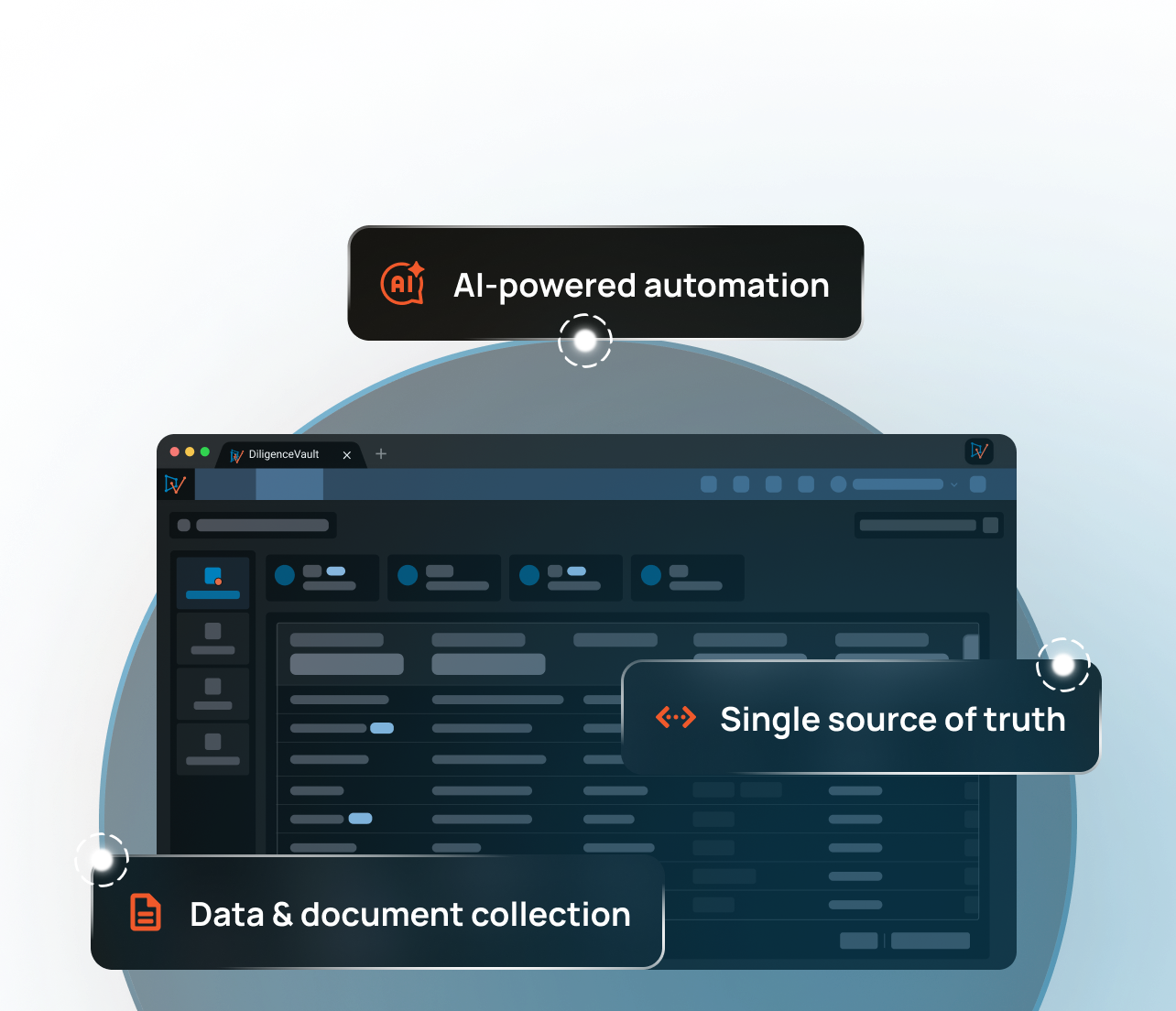

One Diligence Platform. Every Stakeholder.

AI-powered workflows and insights that connect allocators and managers through a single, structured diligence ecosystem.

Deploy a reusable, standardized data layer to power diligence, reporting, and portfolio intelligence across teams and systems.

Harness SEC Form ADV data to discover managers, monitor changes, and uncover risk and market insights.

Standardize and distribute DDQs to prospective investors while simplifying engagement tracking and follow-ups.

Automate attestations, reviews, and risk monitoring to maintain proactive compliance and transparent stakeholder reporting.

Automate creation, review, and distribution of investor communications to improve accuracy, consistency, and speed to market.

Unify investment and diligence content into a single repository for consistent, cross-platform use across marketing, compliance, and product teams.

Digitize and centralize manager sourcing, evaluation, and monitoring to accelerate investment decisions and streamline IC memo creation.

Build a repeatable, scalable oversight framework for assessing and monitoring delegates and service providers.

Digitally transform due diligence with automated DDQs, document review, risk analytics, and regulatory data integration for scalable oversight.

Harness SEC Form ADV data to discover managers, monitor changes, and uncover risk and market insights.

Streamline ESG and DEI data collection, analysis, and engagement tracking to simplify disclosure and regulatory reporting.

Accelerate and standardize investor RFP and DDQ responses with automated workflows and centralized content reuse.

How Does DiligenceVault Deliver Results?

01

Industry-Focused Technology Solution

Purpose built technology that is designed for our industry’s workflows

02

Unrivaled Network Connectivity

Connected with over 17k asset managers and asset allocator firms

03

Advanced AI Integration

AI integration including AI Writer, Document Intelligence Engine and AI Agents